Ready to grow your solar business with financing?

by EverBright

by EverBright

You’re a solar installer, so you know that convincing a potential customer of the benefits of going solar isn’t too complicated. Still, explaining how they overcome the upfront cost can be challenging.

The cost of solar has dropped in recent years. But, for the average homeowner, spending five figures upfront—especially on an investment that could take years to break even—can sometimes be a challenge.

It’s no secret that more homeowners are financing solar rather than paying cash upfront.

Offering loans, leases, and other financing options makes solar panel installation more attainable to the average homeowner—turning it from a potential big hit to their household budget into a wise investment.

But integrating a full range of financing options into your business isn’t easy. And matching customers with the best solar financing option for them—let alone explaining it to them—can also be challenging. But it doesn’t have to be.

To make solar financing easy to understand and sell, let’s break it down into two categories:

Customer-owned systems

- RICs

Third-party-owned financing

- PPAs

- Solar Lease

Customer-Owned

Customer-owned solar financing option lets the customer pay off their installation over time. The homeowner makes monthly payments over time, typically 10-25 years, with a low or even $0 upfront payment.

A common financing option for owning an asset (be it a car or solar panels) is a Retail Installment Contract (RIC), where you essentially upgrade to solar by agreeing to make payments over time.

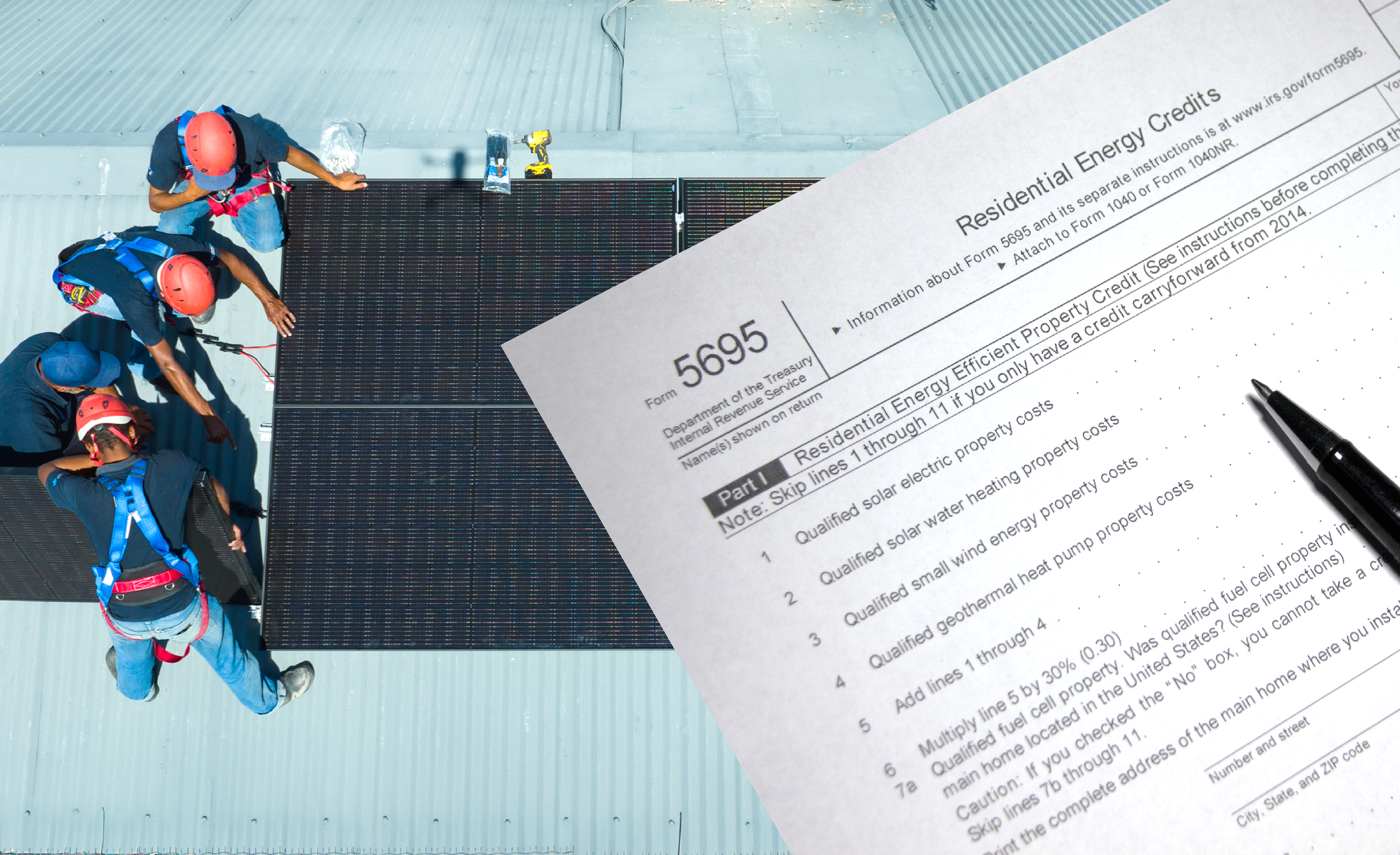

Customer-owned solar financing can provide several financial advantages: a solar tax credit and increased property value. On the flip side, RICs have high credit score requirements, which can be a barrier for some customers.

Third-Party-Owned

Solar leases and PPAs are perfect if you want to go solar, lock in a predictable energy cost, aren't concerned with tax credits, and enjoy your solar system being managed and maintained professionally.

With a lease, you’re financing a solar system and paying monthly installments based on the total cost of the system, not system performance. Typically, a lease is an option in states where PPAs are unavailable.

A Power Purchase Agreement (PPA) is a homeowner and solar company financing agreement. The company installs and maintains a solar system on the homeowner’s property, and the homeowner agrees to purchase the solar energy produced by the solar system at a $/kWh rate (with an agreed-upon annual rate of escalation). A PPA is a good option for homeowners who want predictable energy costs, no upfront or maintenance costs, and will not benefit from tax credits.

EverBright offers a variety of lease and PPA options with terms up to 25 years.

EverBright Power Purchase Agreements (PPAs) offer predictable energy costs with up to 25 years of worry-free solar energy. As part of the customer's contract, EverBright ensures their solar system generates the agreed amount of energy each month. If it falls short, EverBright will credit them.

Our PPA Plus lets the homeowner add multiple backup batteries to the system.

With a Flex PPA, the customer has performance-based payments; customers benefit by paying only for the energy they use from the solar panels each month rather than estimated or fixed amounts.

EverBright offers a lease in states where PPAs are unavailable and is similar to a PPA in that EverBright owns the solar system and pays for the installation. The difference is that lease customers make monthly payments for the use of the energy generated based on the total cost of the system, not the system's solar production.

The EverBright Shift PPA provides all the benefits of our standard PPA but offers customers the option to go solar and get a battery system explicitly designed for net billing customers with a utility that offers low-value export credits.

Expand your solar business with solar financing.

Understanding these solar financing options is one thing, but explaining them to potential customers is another.

The average homeowner isn’t well-versed in solar, let alone financing. So, educating yourself about the various products on the market is critical.

Conveying expertise and demonstrating that you’re well-versed in all things solar and solar financing will help you build trust and confidence with your potential customers and their referral network.

Recommended Posts

HOMEOWNERS

A beginner’s guide to solar incentives

Feb 6, 2023

From local and state-specific to federal and beyond: this is your guide to all solar incentives, tax exemptions, and rebates.

HOMEOWNERS

How much can solar panels increase my home value?

Feb 5, 2023

Solar energy is a wise investment for your home, from monthly energy cost savings to potentially increasing your home’s resale value by 4.1%.

HOMEOWNERS

Want to finance your home solar system?

Feb 2, 2023

Going solar is still new for most of us and can be a bit intimidating. In this article, we want to help you get familiar with some solar financing options available.