How do Solar Panels Increase Home Value?

by EverBright

by EverBright

How much can solar panels increase my home value?

Experts at Zillow say adding solar panels to your home could increase property value by around 4.1%. On a $300,000 home, that’s a $12,000 increase--which could easily account for a significant return on your solar investment.

For some homeowners, the costs associated with solar installation can seem like a reach. However, the long-term returns on your investment could be realized and enjoyed for decades.

These financial rewards come in more than one form and are accounted for when weighing the long-term value of solar panels.

Monthly energy savings.

The immediate payoff on your investment in home solar is that you produce and consume your own energy, reducing your monthly energy costs and potentially saving you thousands of dollars annually.

Elevate your property’s value.

Wait, installing solar panels will immediately boost your home’s potential sale price? In the paper “Evidence of Rational Market Valuations for Home Energy Efficiency,” the Appraisal Journal found that every dollar saved on energy through solar increases home value by $20.

A $20 to $1 ROI on your solar investment could potentially bump your home’s value by thousands or tens of thousands, further balancing out the initial expense--and reducing your wait time to profit financially.

According to a recent EcoWatch article, you can break even on your solar investment within 8-12 years, sometimes faster, depending on monthly savings on your energy bill.

Now that you know how much a solar investment can increase your home/property value and other short and long-term savings, you can make a more informed decision about exploring solar panels for your home.

*Estimated cost does not include any potential tax credits, grants, or other financial support you may be eligible to receive.

Now that you know how much a solar investment can increase your home/property value and other short and long-term savings, you can make a more informed decision about exploring solar panels for your home.

The typical cost for installing solar panels.

In the U.S., the cost of an average home solar system can vary depending on several factors, including the system's size, sun exposure, and regional variations in installation costs. Government incentives and tax credits can significantly reduce upfront costs, making solar installations more affordable for homeowners.

The best way to understand the cost of going solar is to get a detailed proposal from a local solar installer. Your customized proposal is an essential tool that helps you know the installation cost specific to your home before signing up to go solar.

Your proposal will include information on the size and specifications of the solar system, estimated energy production, projected savings, and a breakdown of costs. It includes customized financial analysis, including the payback period, your return on investment, and potential incentives or tax credits available in your area. Reviewing the proposal lets you decide whether solar is viable and cost-effective for your home.

*Estimated cost does not include any potential tax credits, grants, or other financial support you may be eligible to receive.

Recommended Posts

HOMEOWNERS

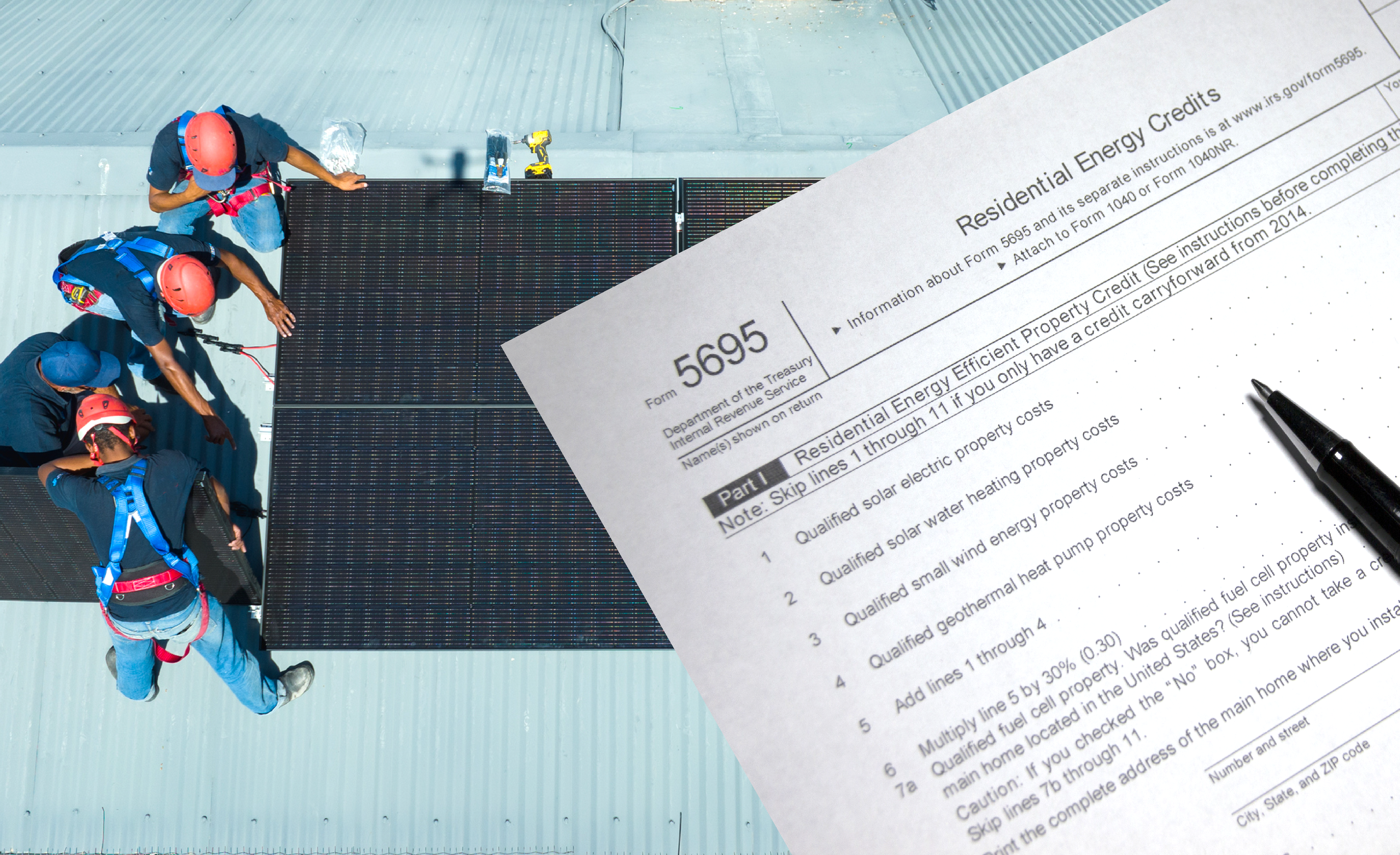

A beginner’s guide to solar incentives

Feb 6, 2023

From local and state-specific to federal and beyond: this is your guide to all solar incentives, tax exemptions, and rebates.

HOMEOWNERS

How much can solar panels increase my home value?

Feb 5, 2023

Solar energy is a wise investment for your home, from monthly energy cost savings to potentially increasing your home’s resale value by 4.1%.

HOMEOWNERS

Want to finance your home solar system?

Feb 2, 2023

Going solar is still new for most of us and can be a bit intimidating. In this article, we want to help you get familiar with some solar financing options available.